SFDR: Guide to the Sustainable Finance Disclosure Regulation

March 20, 2024 • Reading time: 6 Min

The SFDR, also known as the Disclosure Regulation, presents companies with a challenge: the disclosure of sustainable information is becoming increasingly important. As part of the EU Sustainable Finance Framework, the regulation aims to link private investment with sustainability. In practice, this means that the regulation ensures that investors have access to the relevant information to enable sustainable investing. The background to this endeavour is the EU's action plan with the goal of a climate-neutral Europe by 2050. The Disclosure Regulation is relevant in that transparency, long-termism and sustainability in the financial world are to be harmonized under its umbrella. At the same time, the danger of greenwashing is to be reduced and prevented. The regulation is expected to have a positive impact on the integration of ESG criteria into the investment process and contribute to a more sustainable economy in the long term. This blog post highlights everything you need to know on the topic: the impact of the Sustainable Finance Disclosure Regulation, key terms and their meaning, as well as challenges and opportunities that arise for you from its application.

In short: The Sustainable Finance Disclosure Regulation at a glance

The Sustainable Finance Disclosure Regulation (SFDR) is part of the EU Sustainable Finance Framework and aims to connect private investments with sustainable principles. Its purpose is to ensure that investors receive relevant information to make sustainable investment decisions. The SFDR came into effect on March 10, 2021, and affects various market participants such as financial institutions, asset managers, and investment funds. It requires the disclosure of Environmental, Social, and Governance (ESG) criteria and contributes to strengthening the market for sustainable investments.

The SFDR distinguishes between company-specific and product-specific disclosure obligations. For example, companies are required to explicitly state on their websites whether they consider the impact of their decisions on sustainability factors. In addition, financial market participants must provide information on how they consider sustainability risks in their investment decisions.

The SFDR classifies financial products into three product categories based on their impact on ESG factors: Article 6 financial products consider ESG criteria in their investment decisions or explain why sustainability risks are not relevant to them; Article 8 financial products promote ecological and/or social characteristics; Article 9 financial products are labelled as "sustainable investments" and explicitly pursue sustainable goals.

Transparency and reporting are central aspects of the SFDR. Companies are required to disclose detailed information about their sustainability practices to build investor trust. Transparent communication enables companies to effectively communicate their ESG performance and raise awareness of environmental and social issues.

The SFDR presents both challenges and opportunities. Companies must comply with complex regulations and provide transparent data. At the same time, the SFDR offers the opportunity to offer products that meet the growing demand for sustainable investment opportunities.

Subscribe to never miss any insights.

Receive regular insights and updates on the latest developments in the areas of LkSG, CSDDD, CSRD, ESRS, compliance, ESG and whistleblowing. Our newsletter helps you to simplify your compliance processes.

SFDR: definition, explanation and disclosure regulation

When did the SFDR come into force?

The Sustainable Finance Disclosure Regulation (SFDR) came into force on March 10, 2021 and contains a large number of disclosure requirements. With its introduction, the European Commission has created an important instrument for promoting transparency in the financial sector. Companies and investors must now disclose more detailed information about their sustainable investment strategies and products. The Sustainable Finance Disclosure Regulation affects asset managers and applies to a wide range of market participants, including financial institutions, asset managers and investment funds. The disclosure of environmental, social and governance(ESG) criteria is intended to enable investors to make informed decisions that have a positive long-term impact on sustainability. In this way, the SFDR helps to strengthen the market for sustainable investments and promote responsible capital allocation.

The Disclosure Regulation was supplemented by the Delegated Regulation. This defines the exact content, methodology and presentation of the information to be published and the exact sustainability indicators to be recorded, thereby improving their quality and comparability. The first Regulatory Technical Standards (RTS) have been in force since January 1, 2023.

What does the Disclosure Regulation say?

The Disclosure Regulation is intended to create greater transparency and clarity with regard to sustainable investments. It requires financial market participants and financial advisors to disclose information on environmental, social and governance criteria in order to inform investors about the sustainability of their investments. The Disclosure Regulation consists of two main parts: the obligation to disclose sustainability information and the obligation to integrate sustainability risks into the investment decision-making process. This should enable investors to make better decisions that are both financially profitable and take into account positive environmental and social impacts.

Who is subject to the disclosure obligation?

The Sustainable Finance Disclosure Regulation plays a decisive role in the financial sector, as it provides a clear framework for the integration of sustainability aspects into investment strategies. According to Article 2 of the SFDR, the regulation covers financial market participants such as investment funds, asset managers, pension funds, insurance companies and financial advisors. However, the regulation applies not only to EU-wide companies, but also to third countries such as Switzerland, provided that they offer their services within the EU or have their registered office there. Overall, the regulation should help to improve transparency and comparability in the area of sustainable finance and enable investors to make informed decisions.

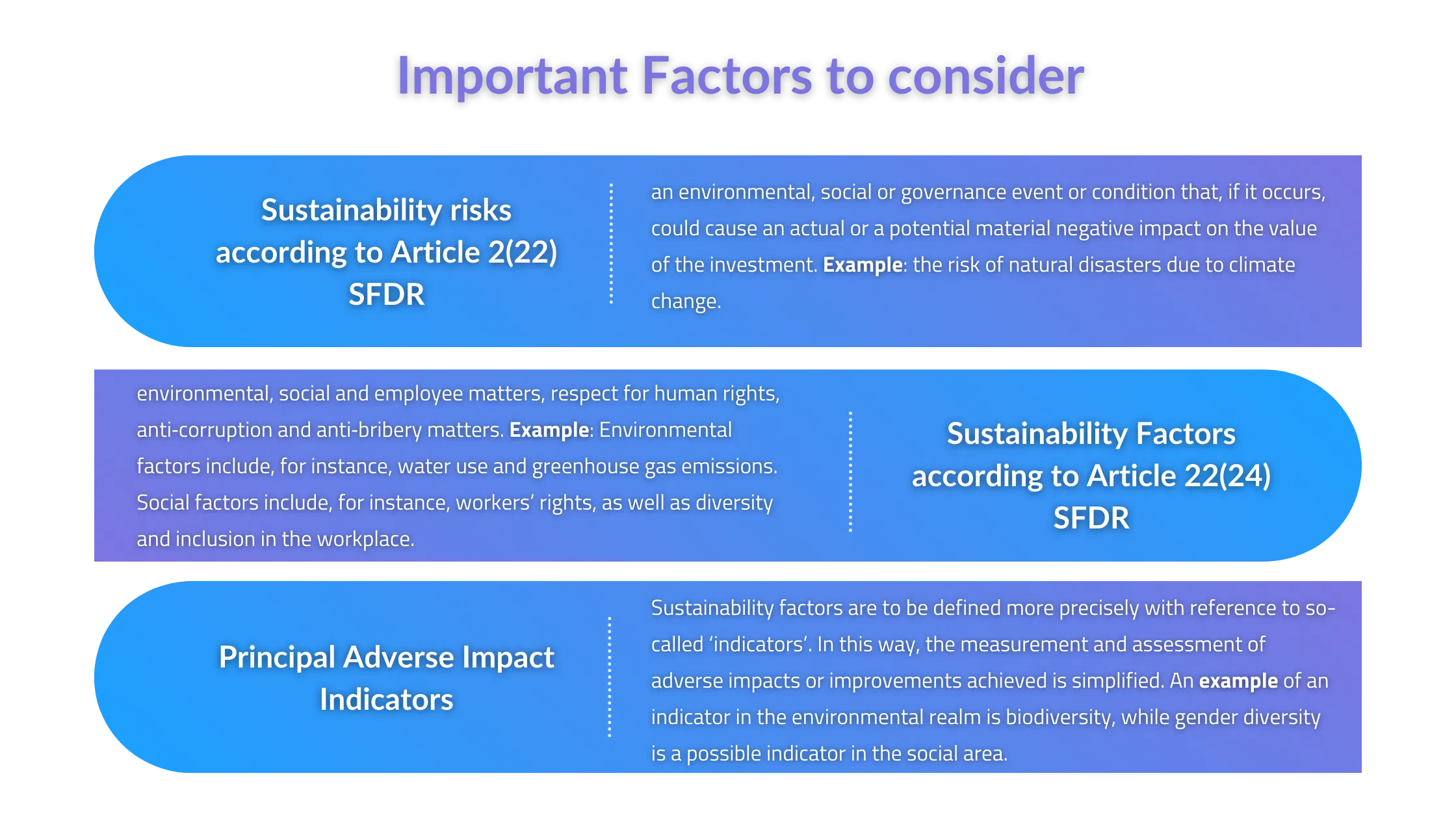

Differences between company-related and product-related disclosure obligations

Among the company-related disclosure obligations, Article 4 SFDR is essential, as it regulates the PAI statement (Principal Adverse Impacts Statement), which requires transparency on the websites of financial market participants. Specifically, this means that financial market participants must provide information on whether they take into account the principal adverse impacts of investment decisions on sustainability factors. If they do so, they are obliged, for example, to disclose the nature and scope of their activities, including their carbon footprint. If the adverse impacts on sustainability factors are not taken into account, they must justify this.

Articles 6, 8 and 9 SFDR are relevant with regard to product-related disclosure obligations. Accordingly, financial market participants must provide information on the consideration of sustainability risks in their investment decisions for each financial product that meets the requirements of the EU Disclosure Regulation. Further requirements apply in particular if the financial products are advertised with environmental and/or social characteristics (Article 8 SFDR) or marketed as a sustainable investment (Article 9 SFDR). Article 11 SFDR therefore applies to such financial products and provides for regular reporting on the extent to which these sustainability goals are achieved. In addition, Article 10 SFDR requires them to publish the information required under Articles 8, 9 and 11 SFDR on their website.

The EU Disclosure Regulation specifies the obligations in the Delegated Regulation, which sets out regulatory technical standards for the disclosure obligations under Articles 4, 7, 8, 9, 10 and 11 SFDR.

LkSG, CSRD, HinSchG - implement all laws in practice now

With the lawcode Suite, you can implement your data in a legally compliant, simple and secure manner. Find out more in a personal consultation with our experts.

Role of transparency and reporting

Transparency and reporting play a central role in the Sustainable Finance Disclosure Regulation. Companies must disclose accurate information about their sustainability practices and objectives in order to meet the requirements of the regulation. This enables investors and other market participants to make informed decisions in line with their sustainability goals. Transparency promotes trust in the market and creates a solid foundation for sustainable investment. Through clear reporting, companies can effectively communicate their ESG performance and raise awareness of environmental and social issues. Transparent communication is crucial to achieve the goals and support the transition to a more sustainable finance industry.

Categorization of sustainability funds: How ESG criteria are shaping the future

The categorization of sustainability funds is an important step towards promoting sustainable investments. By providing clear guidelines and transparency, the regulations create a basis for investors to better understand the sustainability of funds. Taking ESG criteria into account, the regulation enables a differentiated classification of investment products. Investors thus receive well-founded information on the sustainability level of a fund and can invest in ESG-compliant products in a more targeted manner. The categorization also serves to protect investors' interests and promotes trust in the sustainable financial market. Companies are required to fully comply with the disclosure obligations under the regulation in order to present their sustainability efforts transparently and position themselves positively in the market.

The SFDR categorizes according to 3 product classes

-

These more traditional financial products take ESG characteristics into account in the investment decision or explain why sustainability risks were not considered relevant. This is also known as "comply or explain".

The financial product does not meet the additional criteria of Articles 8 and 9 SFDR.

-

These products advertise with ecologically sustainable and/or social features.

-

These financial products describe themselves as "sustainable investments" and strive to achieve sustainable goals.

Challenges and opportunities

The integration of environmental, social and governance criteria in accordance with the regulation is of crucial importance for companies. By taking these criteria into account, they can not only minimize environmental and social impacts, but also create long-term value. The SFDR framework sets out clear requirements for the disclosure of these criteria to promote transparency and accountability. Companies that incorporate ESG factors into their investment decisions are actively contributing to sustainable development while meeting regulatory requirements. Integrating the criteria offers an opportunity to drive positive change and be successful in the long term, but also comes with particular challenges. It is therefore essential that companies address the requirements of the regulation.

Interaction with other regulations

The EU Taxonomy, the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation are components of a comprehensive "Sustainable Finance Framework" of the European Union, which defines sustainability criteria for various areas of the economy.

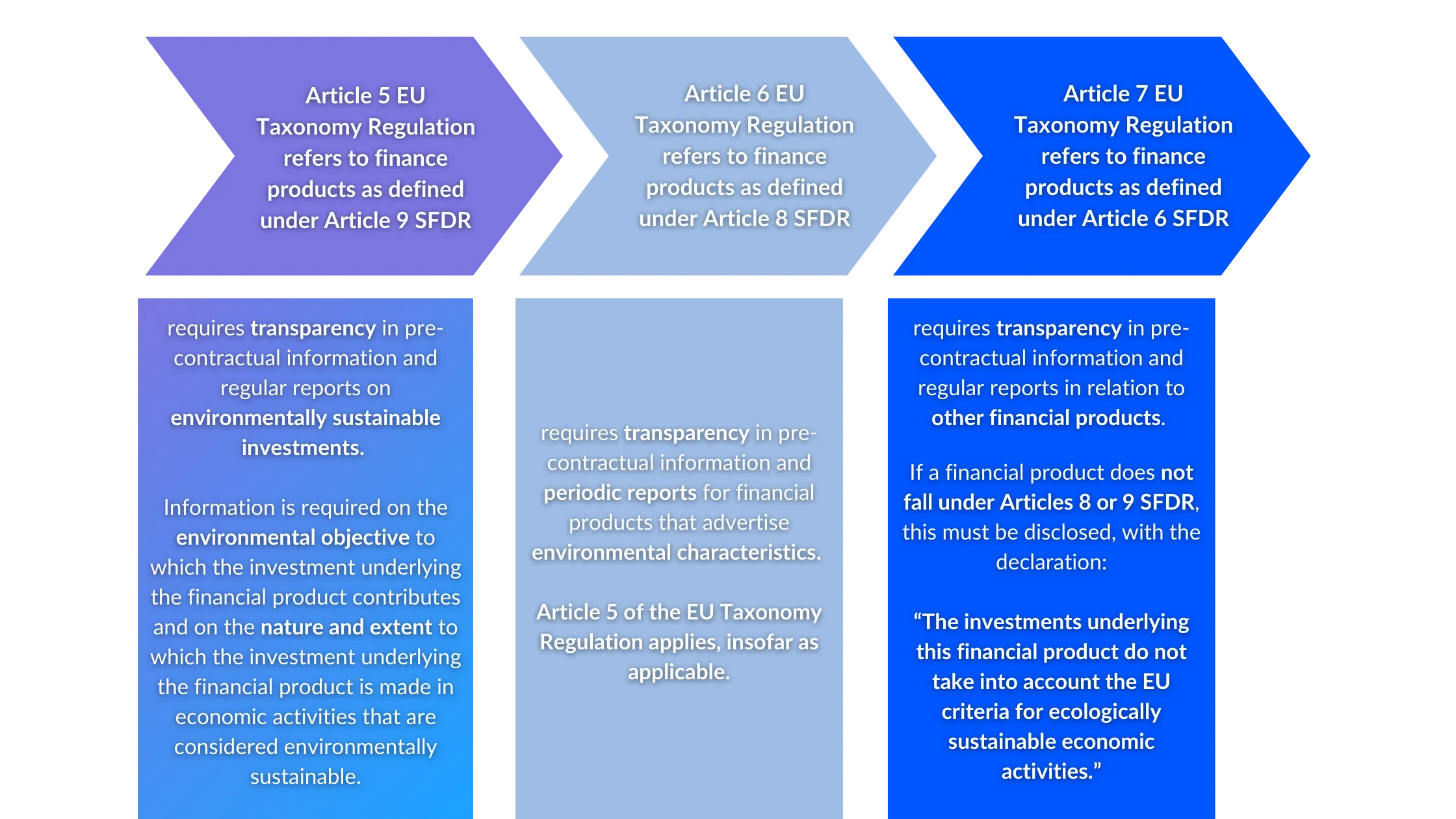

The EU taxonomy determines what is sustainable

The Taxonomy Regulation came into force on January 1, 2022 and has been integrated into the disclosure requirements of the SFDR since January 1, 2023. This interaction affects the product-related disclosure obligations for financial products under Articles 8 and 9 SFDR, which are supplemented by Articles 5 to 7 of the EU Taxonomy Regulation.

In practice, this means that the financial products under Articles 8 and 9 must be compatible with the requirements of the EU Taxonomy or it must be disclosed that these products are in line with the EU Taxonomy Regulation. The compatibility of financial products can be measured using key figures and a taxonomy ratio, which sets the proportion of sustainable investments in relation to total investments.

The CSRD and SFRD also go hand in hand

CSR reporting is playing an increasingly important role in the corporate world: by publishing reports on environmental impact, social projects and ethical standards, companies demonstrate their responsibility towards society.

The directive came into force on January 5, 2023 and stipulates that companies in the business sector must publish sustainability information about their business activities. Financial companies that are subject to the provisions of the regulation therefore require sustainability information from the companies in which they invest in order to comply with their CSR obligations. For example, greenhouse gas emissions must be reported.

Tips for companies

Here are three practical tips for dealing with the regulation:

- The further development of the regulation should not be lost sight of: The guidelines and explanations of supervisory authorities such as the EBA, EIOPA and ESMA are constantly changing - so always stay up to date.

- Another important aspect is the interplay between SFDR, EU taxonomy and CSRD. It is essential to follow these developments closely in order to always be up to date.

- It is equally important to observe and take into account developments outside Europe. The global market for sustainable finance is constantly growing and international standards can have a significant impact on European regulation. We must therefore also keep an eye on trends and initiatives in other regions such as the USA or Asia.

It is therefore not only important to comply with static requirements, but also to keep up to date with new guidelines and explanations from the supervisory authorities. This is the only way to ensure that the requirements for sustainability and transparency in the financial sector are met.

Conclusion

Future prospects: More transparency, responsibility and sustainability under the influence of the SFDR

The future prospects under the influence of regulation are promising. With its clear focus on transparency, responsibility and sustainability, it will drive positive change in the financial sector. Companies and investors will be increasingly encouraged to integrate ESG criteria into their decision-making processes and thus create long-term value. Increased disclosure of sustainability-related information will enable market participants to make more informed investment decisions while raising awareness of environmental and social issues. The SFDR will therefore not only improve financial performance, but also make an important contribution to the global transition towards a more sustainable economy.